Tipped to reach a market size of approximately $1.489 trillion in 2024, the luxury travel market is on the rise, increasing at a CAGR of 7.9% a year between 2024 and 2030.

To find out more about who is contributing to this increased growth, we surveyed over 158,000 people who fall into the high net worth category. Our data covers a full 12 months ending November 4th, 2024, revealing some interesting sights about what people prioritize in luxury travel.

Index

- 30.1% of respondents have visited the Amalfi Coast

- Luxury train tours the most popular type of tour with 24% of respondents

- 36.2% of respondents prioritize sustainability when booking a destination

- Unique experiences motivate 27.5% of respondents to choose a tour

- Private yachts top engagement levels at 40.4%

- Sustainable travelers make up the majority at 27.4%

- 47% of respondents think of the Four Seasons first for booking luxury travel tours

- Over 65s make up 34.8% of engagement

- Female travelers top the luxury list at 61.3%

- North Americans make up 52.5% of luxury travelers surveyed

- 29.6% of respondents earn between $200,000 to $500,000

- About the data

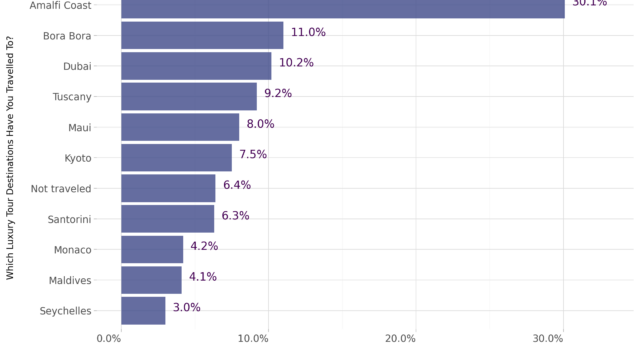

Which Luxury Tour Destinations Have You Traveled To?

30.1% of respondents have visited the Amalfi Coast

From the most to the least visited, our graph reveals which luxury destinations are popular with those we surveyed:

Italy’s Amalfi Coast attracts more than 5 million visitors a year and is so popular it’s now getting its own airport. This UNESCO-designated region also tops our list, recording 30.1% engagement levels. Lagging 19.1% behind in second place is the French-Polynesian island of Bora Bora with 11%, followed by Dubai at 10.2%.

Italy appears again as the 4th most popular spot, with Tuscany attracting 9.2% engagement levels, followed by Hawaii’s Maui (8%), Japan’s Kyoto (7.5%) and Greece’s Santorini (6.3%). Famed playground for the rich, the sovereign state of Monaco on the French Riviera has been visited by 4.2% of respondents, followed closely by the Maldives at 4.1% and Seychelles with 3%. Interestingly, 6.4% of respondents said they had not traveled, despite recent reports showing that 44% of high-income consumers say that travel is now more of a priority to them than it was in the pre-pandemic era.

What Types Of Luxury Travel Tours Do You Purchase?

Luxury train tours the most popular type of tour with 24% of respondents

From luxury trains to private yachts, we unpack what our data shows about the types of tours that are tops:

With nearly a quarter of respondents (24%) purchasing luxury train travel tours, it seems the romance of the rail isn’t dead. Globally, there’s been an increase in train tickets, with the market set to generate revenue of US$134.70 billion in 2024, and this mode of transport is proving popular for luxury travel, too. Just behind trains are adventure travel tours, with engagement levels of 22.3%, followed by wellness retreats with 17.1%.

High end cruises remain relatively popular, with 8.2% engagement, highlighting the fact that a 13.8% increase was predicted in cruise industry revenue between 2023 and 2024. Private jet tours tie with 8.2% engagement too, and the private jet charter industry is also enjoying good growth, with predictions of a compound annual growth rate (CAGR) of 13.92% between 2024 and 2029.

Exclusive wine tours racked up engagement levels of 7.7%, followed by luxury safari at 5.9%, and gourmet food at 3.6%. The least popular types of luxury tours with our respondents were private guided tours (2.7%), followed by private yacht, at just 0.4%.

What Features Influence You Most When Booking Your Next Destination?

36.2% of respondents prioritize sustainability when booking a destination

Green travel is growing in popularity, and it’s something our respondents clearly prioritize. Here’s what influencing factors affect destination bookings:

A 2024 Sustainable Travel Report revealed that 75% of global travelers want to travel more sustainably in the next year, and our respondent’s engagement levels correlate with this. 36.2% are most influenced by sustainability practices when choosing a destination, highlighting just how important this factor now is. Luxury accommodations come in second as an influencing factor at 19.1%, and culinary offerings in third with 14.7%.

Destination reputation is also important, with 8.8% of respondents agreeing this is an influencing factor, while cultural immersion attracts 8% engagement. Other factors that don’t attract much engagement but are still important to high net worth travelers include itinerary flexibility (5.4%), unique experiences (5.3%), personalized service (2.2%), and lastly, safety and security at a very low 0.2%.

What Motivates Your Choice Of Luxury Travel Tour?

Unique experiences motivate 27.5% of respondents to choose a tour

While unique experiences only garnered a 5.3% engagement rate when respondents were asked what features influence them most when booking their next destination, it tops the list for motivating choices. Here’s what else the graph reveals:

With engagement levels of 27.5%, unique experiences are the biggest motivating factor with our respondents when booking a luxury travel tour. While these experiences may not hold much sway over choosing a destination, they certainly impact the motivation behind selecting a specific tour. However, luxury accommodations (22%) and sustainability(21.9%) are clearly priorities as both features influence the choice of destination and motivation to visit.

Wellness options are the fourth most popular motivation for respondents at 12.2%, and this reflects the growing trend of wellness travel and the growth of the global wellness economy that hit $6.2 trillion in 2023. Dipping down 7.9%, personalized service only garners 4.3% engagement, followed by gourmet dining at 3.9% and privacy at 3.6%. Itinerary flexibility scores low down again, with 3%, followed by cultural immersion (1.4%) and exclusivity at just 0.2%.

What Has Been Your Most Frequent Mode Of Transport When Traveling On Vacation?

Private yachts top engagement levels at 40.4%

Discover what our data reveals about the most popular modes of transport with high net worth travelers:

Of the 158,201 people surveyed, luxury yachts are by far the most popular frequent modes of transport used when traveling on vacation. So much so that there’s a 17.9% difference between those who travel most by luxury yachts (40.4%) and those using private jets (22.5%). First-class flights come in a close third to private jets, with 19.5% engagement, before dropping down to 8.7% of those who most frequently use helicopters.

Following this in fifth to ninth place, we have luxury RV (3.3%), chauffeured car (2.5%), private car service (1.3%) and limousine (1%). The least-most frequent option is train at just 2%, which creates an interesting contrast with the earlier results of train topping the list of the most-purchased type of luxury travel tours.

What Type Of Traveller Are You?

Sustainable travelers make up the majority at 27.4%

Once again, our research shows that sustainability is a key trend with high net worth travelers:

Topping engagement levels with 27.4%, the highest number of our respondents describe themselves as sustainable travelers, tying in perfectly with the trends we see in the other graphs. In second place are business travelers at 25.5%. This type of luxury travel is on the rise, with the market size growing rapidly in recent years. In 2024, it’s predicted to reach $1696.93 billion in 2024 at a CAGR of 5.2%

Adventure travelers took the second spot in the types of luxury travel tours purchased, and they take third here, with 17.2% engagement. Dropping to 10.6% and fourth spot were those identifying as family vacationers, followed by 6.5% wellness travelers, and 4.6% food and wine lovers. Luxury seekers and cultural explorers were separated by a point of a percent at 4.1% and 4%, respectively, and relation enthusiasts only got 0.1%. Exclusive experience travelers didn’t rack up any engagement, scoring 0%.

When Booking Your Next Luxury Travel Tour, Which Company Do You Think Of?

47% of respondents think of the Four Seasons first for booking luxury travel tours

The Four Seasons is by far the first company respondents think of for luxury travel tours; here’s how the rest of the companies compare:

Approximately 74,354 of our respondents (47%) think of the Four Seasons when booking their next luxury travel tour. As the brand has 128 hotels and resorts across 47 countries, it’s not hard to see why it’s the majority choice. With 35 properties in 20 countries, Aman Resorts has the second-highest engagement level at 25.8%. Trafalgar follows with 11.8%, Luxury Escapes at 6.3%, and Ritz Carlton at 4.5%.

Luxury brand Belmond, owned by the world’s leading luxury group, LVMH (Moët Hennessy Louis Vuitton), was the last company on the list to achieve engagement levels of over 1%, coming in at 3.6%. Thereafter, Virtuoso had 0.9% and Abercrombie and Kent 0.1%, while Scott Dunn and Black Tomato both had 0% engagement.

Demographics

In addition to surveying engagement levels, our data also breaks down the age, gender, region

and income of our respondents.

Age

Over 65s make up 34.8% of engagement

The oldest age group of those surveyed was also the largest. Here’s how our survey was segmented by age:

According to McKinsey, spending on travel peaks between the ages of 40 and 60, while Statista reports that around 58% of affluent consumers aged 40 and over make multiple travel purchases annually. Our data reflects similar trends; only those over the age of 65 had the highest engagement rates at 34.8%, followed by 55-64-year-olds with 21.6%, 45-45 with 15.3% and 35-44 with 12.3%.

Under 25s came in second last with 9.1%, while those aged 25-34 made up the lowest engagement levels at 6.9%.

Gender

Female travelers top the luxury list at 61.3%

Find out what the gender gap is with luxury travelers based on our data:

With 61.3%, female travelers were more engaged on the topic of luxury travel. In contrast, men scored engagement levels of 38.7%, putting them far behind. This correlates with a recent study that revealed women accounted for up to 80% of all travel bookings, and there’s been a marked increase in the rise of solo female travelers. While men may travel more for business, women are certainly traveling more for leisure.

Regional Distribution

North Americans make up 52.5% of luxury travelers surveyed

North America had the highest number of respondents and Latin America the least. Let’s take a closer look at our data’s region distribution patterns.

With 52.5% engagement, North America had the highest number of respondents contributing to our survey. Europe followed at 36.2%, and Oceania lagged behind with just 9%. Latin America was last in line with 2.3%, which makes sense as it is the region with one of the largest divides between the wealthy and the poor.

Income Distribution

29.6% of respondents earn between $200,000 to $500,000

Based on our research, nearly a third of respondents earn within the same income bracket. We’ve broken down the income groups of those who participated in our survey.

Research from The Olinger Group found that the target market for luxury travel is those earning $250K and up. This aligns with the 29.6% of our respondents who earn between $200,000 and $500,000. Additionally, McKinsey reports that in the last year, there have been a growing number of aspiring luxury travelers with lower net worths (between $100,000 and $1 million) accounting for 35% of spending in the segment.

Our data reflect this trend, too, with engagement rates of 22.1% for those earning between $80,000 and $120,000 and 20.5% for those between $120,000 and $200,000. Those earning $40,000 to $80,0000 also had good engagement rates, at 20.6%, highlighting the fact that even the lower earners are following the luxury travel trend.

It’s unsurprising that those earning in the lowest income bracket (under $40,000) only had engagement of 3.5%, but those earning the most ($500,000 to $1 million and over $1 million) also registered very low engagement at 3.2% and 0.5%, respectively. However, this doesn’t mean the higher earners don’t travel; it simply means they don’t perhaps share as much about their experiences online as they’re more accustomed to this way of seeing the world.

Overall, 2024’s luxury travel statistics reveal interesting trends about those who enjoy this type of travel, the experiences they seek, and their priorities. As the industry grows, it will be interesting to see what new trends and patterns emerge and whether sustainability will remain such a prevalent factor in how people choose where they visit.

About The Data

The data we used to create our graphs was sourced from an independent sample of 158,201 high net worths globally on X, Quora, Reddit, TikTok and Threads. The responses are collected within a 75% confidence interval and 5% margin of error. The engagement percentage estimates how many people in the location are participating. Demographics are determined using many features, including name, location, and self-disclosed description and sample group privacy is preserved using k-anonymity and differential privacy. The results are based on what people describe online; the questions were not posed to the sample group directly.